Newsletter 67 – Crisis! What Crisis

- Posted by IanMuttonAdmin

- On February 21, 2025

- north sydney council, north sydney rates

- Ladies and Gentlemen,

Today I received an email from resident of North Sydney. He and his family lives in a “workers” cottage in Crows Nest; for them it is a struggle to make both end meet – now, if Council gets its way, this family will be hit with a rate increase from $1,697 to $3,173. We do have a cost-of-living crisis and Council is intent on fueling it.

The question of capacity to pay is critical for a lot of people resident in North Sydney – keep in mind, around

- 15% of households in North Sydney have an income of less than $1,000 per week.

- 24% of residents earn less than $1,000 per week.

Back to the email; it caused me to pause and wonder why Council suddenly thinks it has a financial crisis – I mean to say, in the report to the next meeting of Council it says it has:

- $141 million in cash and investments (down $3 million from a year ago), and

- around $60 million in debt (the bulk of which is attributable to the pool and nearly $28 million of which is not due to be completely paid off until 2042).

That seems a healthy financial position to me!

Dare I suggest, Council has scoped a “crisis” that does not exist and now is seeking approval to impose – a solution, a rate increase of 87.5%, that’s not needed.

North Sydney residents are entitled to have a Council that:

- Has and demonstrates administrative competence.

- Delivers financial reporting that is clear.

North Sydney Council says it has a financial crisis and is arguing for a Special Rate Variation (SRV) of a breath taking 87.5%.

With North Sydney Council we have two major issues:

- An absence of administrative competence for which there is no better example than the Olympic Pool rebuild.

- Opaque financial reporting accompanied with changes in reporting methodology that’s used to found a foreshadowed application to the State Government (IPART) for approval of a rate increase of as much as 87.5%.

Is there really a financial crisis at North Sydney Council or is Council entering the “Twilight Zone”?

In 2022/23 Annual Report:

- Mayor Zoe Baker stated:

Council remains in a strong financial position)

- The CEO was silent on financials but in the Operational Plan presented to Council in June 2023 she stated:

I am pleased to report that Council’s finances are sound. A deficit of $2 million is forecast for the 2023/24 financial year, however, this is largely due to a previous commitment to a $2.2 million contribution to an affordable housing project. Without this commitment, we would have been forecasting a small surplus. Rates will not increase above the rate peg of 3.7% set by the Independent Pricing and Regulation Tribunal.

Next, in September 2024 there is a Local Government election. Nothing, not a thing, had been suggested to the electorate that Council was other than in a strong financial position.

Then in October 2024, with the newly elected Council in place, the 2023/24 Annual Report is published, in which:

- The Mayor stated:

The rising costs associated with this project (pool) have significantly affected Council’s financial position and will have enduring implications for the future.

- The CEO stated:

Coupled with recent revenue reductions and a growing backlog in infrastructure renewal, these financial pressures have placed the Council in an unsustainable position.

What changed between 2022/23 and 2023/24?

Why was it not reported to voters prior to the September 2024 election?

Let’s deal with the major issues said to be impacting on Council’s financial position:

- Olympic Pool, and

- Infrastructure renewal.

First the Olympic Pool – Administrative Competence and the North Sydney Olympic Pool rebuild.

In 2022/23 Council reported that:

- Variations to contract at $3.8 million and to design and consultancy at $3 million”.

- Between $25 million and $30 million in additional budget allocation will be required to allow for the successful pool opening and operation of the project i.e. cost for completion at between $95.7 million and $105.7 million.

In April 2023, following an “independent” report by PriceWaterhouse Coopers. the Mayor noted in an open letter to the community that current estimates suggest an additional $25 million to $30 million will be required to complete the redevelopment project and ensure the facility is ready to open, and went on to write:

I can assure you that Council’s finances are sound, and the additional cost can be managed without reducing service levels.

In February 2024 the Mayor said on ABC radio that the cost was going to be a $100 million.

In December 2024 Council reported the revised construction contract sum to be $91.57 million but noted it was aware of significant variations that are still to be lodged.

Broadly put, the cost of the constructing the pool was hovering around $100 million in 2023 and throughout 2024.

Simply put, the contract to rebuild the pool:

- was made in December 2020 providing for completion by November 2022 at a cost of $63.4 million, and

- remains to be completed.

The Mayor blames the Council of 2018 to 2021 and overlooks that the task of managing the project has been on her watch since her election in December 2021. That said, she has asserted that the cost can be managed. To be candid, the cost could easily be covered by selling some of the commercial properties owned by Council – simply, by repurposing assets.

Second Infrastructure Renewal.

The need for a SRV has been contrived by broadening the definition of assets that need to be brought up to a “satisfactory standard”. This has been done with two strokes of a pen.

Stroke of the Pen – short term impact.

All councils raise provisions to bring assets to satisfactory standard – those that:

- need to be done now (i.e. in the year ahead) are classified as category 5; and

- can be done later (in another financial year) are put into another category, a category ranging between 1 and 4.

It is simply an exercise in long term planning and budgeting.

Council in:

- 2022/23 raised a provision in respect of category 5 assets but in

- 2023/24 reclassified assets in category 4 to fall in category 5

That reclassification, at the stroke of a pen, brings forward the estimated expenditure from $45.7 million to $146.8 million.

The reclassification puts North Sydney Council at odds with all other metropolitan councils.

The result was that North Sydney Council estimated the cost to bring assets to an agreed level of service at over double that of other Sydney metropolitan Councils.

Because the “increase” in the rate will be permanent, a consequence is that the forecast cash at bank will, over the next 10 years, increase to $112 million. An increase that begs the questions why is so much cash needed?

Then there is the issue of how Council intends to spend the extra half billion dollars raised over the ten years following the increase.

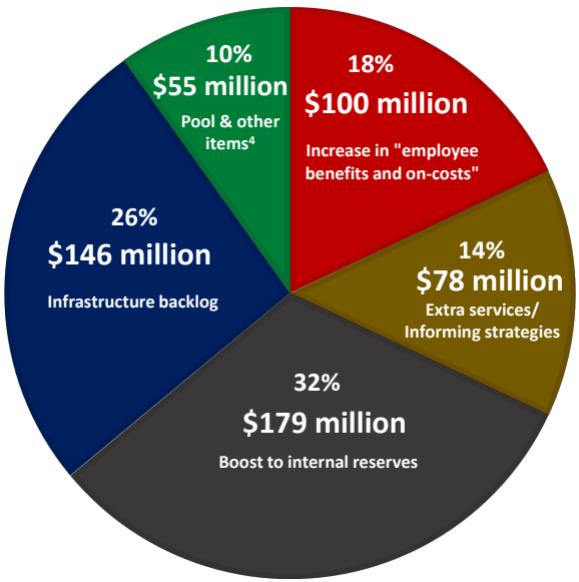

The analysis (diagram below) of how Council intends to spend the extra half billion dollars raised puts to an end any suggestion of a “financial crisis”.

For a better understanding view the video of Dr David Bond at https://www.youtube.com/watch?v=sFTdUSM_GJo

No other Sydney metropolitan council has seen it necessary to reclassify its assets at the stroke of the pen.

North Sydney should simply:

- restate its accounts to conform with local government practice (by not taking the stroke of the pen),

- forecast its 10-year outlook with reference to the community, not Councillor vanity projects, and

- then, after being informed by the restated accounts, consult the community on the need, if there is one, for a special rate variation.

Perhaps, of even greater concern was the failure of Council’s executive to report its thinking to Councillors and the community on finances prior to the September 2024 election – the result? A loss of trust.

0 Comments